In a panel discussion at the 1st Annual Conference of the Central Bank of Cyprus, three experts gave their view on the theme ‘Cyprus economy, outlook and opportunities’.

The invitation-only event currently underway in Limassol also included a keynote speech by European Central Bank Vice President Luis de Guindos, following a welcoming address by Central Bank of Cyprus Governor Constantinos Herodotou.

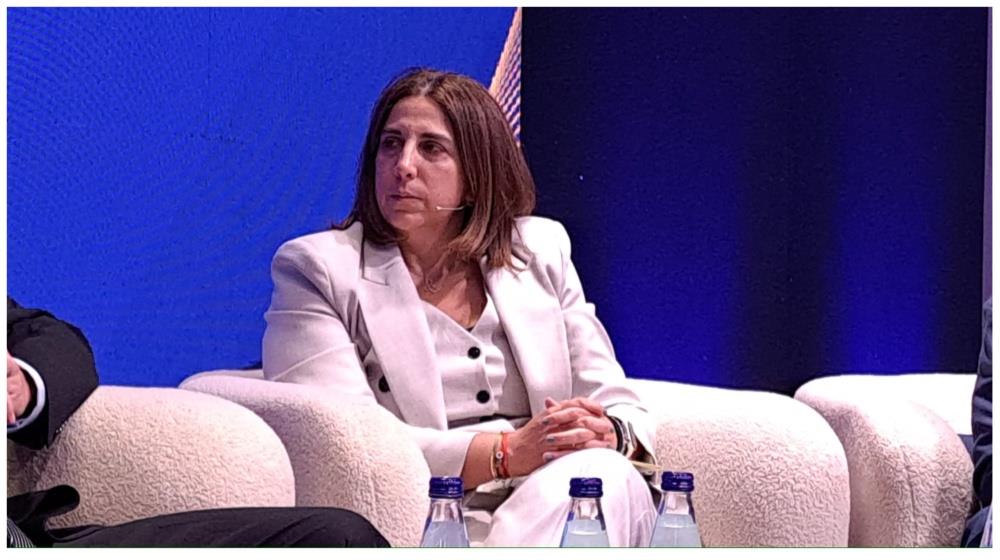

The event included a panel discission on ‘Cyprus economy, outlook and opportunities’ with the participation of Irene Piki, Deputy Minister to the President of the Republic of Cyprus, Panicos Nicolaou, Chairman of the Board of Directors, Association of Cyprus Banks, and Evgenios Evgeniou, Chairman, Invest Cyprus.

Speaking during the panel discussion, Piki noted the importance of the role of the Central Bank and other stakeholders for the country’s financial stability.

“There is also increased pressure on the government to take action,” she continued, adding “The weight on decision-makers has been intensified by the complexity of the current inflationary crisis.”

As noted by Piki, the government needs to weigh its decisions on the one hand to create a balance fiscal policy, and on the other ensure the fiscal fabric of the country.

She said that the had in the seven years since its election, used a people-centred approach including introducing measures for vulnerable and middle-class households among others.

“Last week, an important milestone was approval of the first budget of this government, the budget for 2024. It was structured around macro-economic growth of 2.9% for 2024 with same for the years to follow. It also prioritised strengthening social spending,” she said.

Piki also noted the 15% increase in development expenditures with emphasis on projects within the country’s Resilience Plan, while also maintaining fiscal discipline.

She also noted the state’s priority to ensure public servants were filling their roles properly.

Piki continued that Moody’s recent upgrading of Cyprus and two of its main backs was significant but that there remained a need for further improvement. She also acknowledged the role of the sacrifices made by the people, as well as the fiscal policies followed in these upgrades.

The upgrades were also important for the banks and for efforts to bring more investments into the country.

Earlier, there was also a panel discussion on ‘Inflation uncertainty ramifications on investment and business decisions’ with the participation of João Sousa, Deputy Director General, DG Economics, European Central Bank, and Ernest Gnan, Secretary General, SUERF – The European Money and Finance Forum and Honorary Economic Advisor to the OeNB Governor.

A networking cocktail is due to close the event.