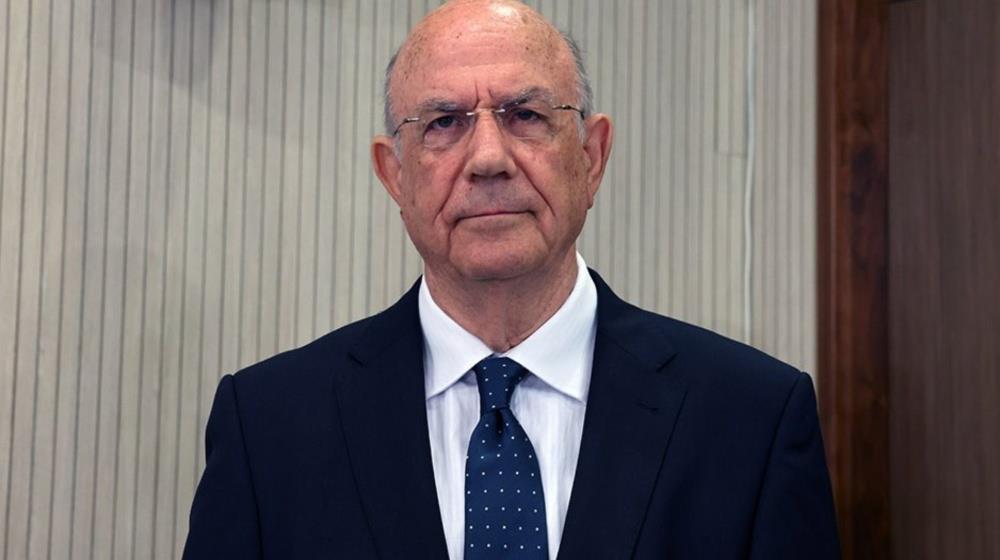

The Cyprus economy has proven its resilience in recent years, though there are still challenges that the banking sector must address, Finance Minister Makis Keravnos told the 4th Conference on "Banking System: New Challenges and Opportunities".

The Minister referred to the successive rate hikes and their impact on the economy, noting that banks have adopted some positive measures, but said that he expects additional positive measures from all banks.

Keravnos said that in recent years, the Cyprus economy has demonstrated its exceptional resilience, effectively coping with many difficulties and challenges.

The banking sector, he added, having made remarkable progress in recent years, with a strong capital base and liquidity, has played a decisive role in this collective effort and is expected to continue to do so.

However, the Minister stressed, there are challenges and risks that must be addressed.

One of the main challenges for the banking sector, he noted, is the series of repeated interest rate rises by the European Central Bank.

Noting that banks have adopted some positive measures to absorb the increased cost due to the increase in interest rates, as well as regarding deposit rates, he expressed confidence that banks, by assuming their social responsibility will continue to closely monitor developments, adding that he anticipates that additional positive steps will be taken by all banks.

Referring to Non-Performing Loans, he said that today the percentage of NPLs has decreased significantly and is a positive development for the Cypriot economy, as it proves that the efforts to manage NPLs and the recovery of the banking sector have begun to yield results.

Keravnos added that the two quantitative targets set by the Resilience and Recovery Plan as regards NPLs have already been met, noting that this will contribute to the disbursement of the next tranche from the Recovery and Resilience Fund.

He also said that the outlook 'is highly encouraging', pointing out that the government has taken important measures and continues to work out more measures to address the problems related to NPLs.

The Minister of Finance said that the banking map in Cyprus has changed radically in the last decade, adding that the Ministry considers any acquisitions and mergers, an indication of a healthy sector and operation of free market rules.

He added that structural changes, whether through acquisitions or technological upgrading, are expected to contribute to strengthening the competition and improving financial services for consumers in Cyprus.

He also referred to the positive ratings from international rating agencies, saying that they are an important sign of confidence, showing that we are on the right path to economic recovery.

Keravnos said it is important to continue to monitor developments adding that he looks forward to their cooperation to mitigate the impact on the market and households.