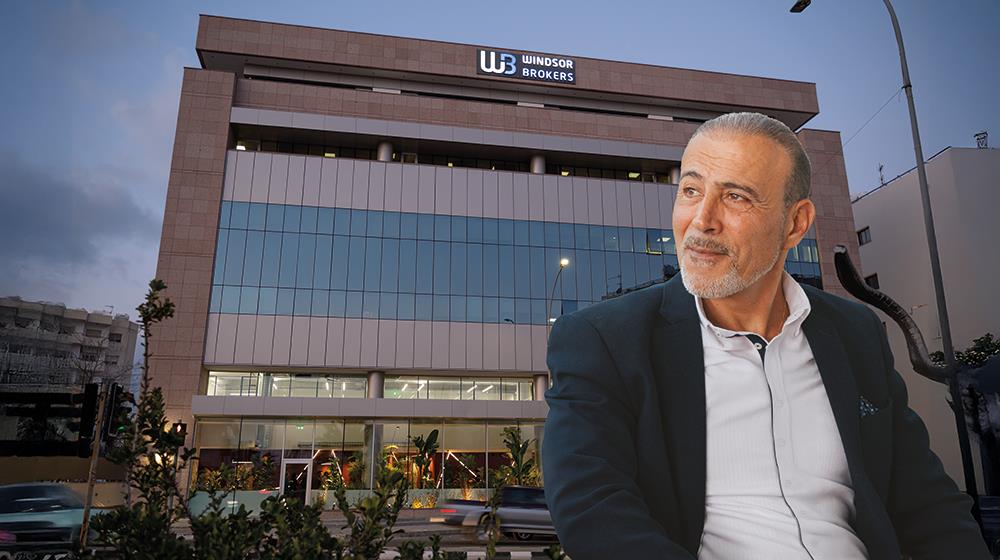

Windsor Brokers CEO Johny Abuaitah explains how regulatory changes are affecting Cyprus Investment Firms and highlights how technological advancements in investment are pushing brokers to offer expanded services that will change the face of the industry.

The EU’s recent regulatory blitz to protect retail investors has kept everyone on their toes. Which recent regulation has been the biggest help to the industry and which one made you feel like squeezing a stress ball?

Among the most recently introduced EU regulations, the Investment Firms Regulation (IFR) and Investment Firms Directive (IFD) stand out as particularly beneficial. These regulations enhance the prudential supervision of investment firms by introducing new capital requirements and a classification system based on a CIF’s activities, size and interconnectedness. These frameworks ensure that CIFs operate with greater financial stability and transparency, ultimately fostering a safer environment for retail investors.

On the flipside, I believe that one of the most recent directives that has posed considerable challenges is the Capital Requirements Directive V (CRD V). While the directive’s intention to improve risk and compliance management is commendable, its implementation has been taxing for some brokers. The increased compliance requirements and the need for extensive adjustments in operational processes required significant resources and time to ensure full compliance. This was definitely something that Windsor Brokers was able to handle but it still posed major challenges for smaller brokers.

With 253 CIFs now on CySEC’s books, Cyprus is looking like the EU’s CFD broker capital. How would you assess the local market’s growth and what more can be done to attract more firms to Cyprus?

Cyprus has made significant strides towards becoming the fintech capital of the EU. This growth is driven by its favourable regulatory and corporate tax environment, strategic EU location and highly skilled workforce. CySEC’s robust regulatory framework also ensures investor protection while allowing financial services firms to continuously innovate and expand. I am confident that Cyprus will continue to attract more CIFs and drive growth in the financial services sector as it leverages its strengths. To further enhance its appeal, Cyprus could invest in cutting-edge digital infrastructure and continuously update its regulatory frameworks to keep pace with global financial trends. Additionally, offering incentives for research and development in fintech and strengthening international collaborations can spur innovation and attract global players to the island.

Every industry has its roadblocks but what would you say are the biggest challenges ahead for the industry?

As part of their global expansion efforts, legacy brokers like Windsor Brokers are continuously adding local licences in major markets such as MENA, LATAM and Asia. Naturally, local regulators maintain different requirements, necessitating local offices, tailored payment options and strategic partnerships for a seamless customer-centric experience. This expansion, in turn, presents significant challenges for brokers. It demands substantial investment in operations and necessitates navigating ever-changing regulatory frameworks. Brokers must therefore be able to exhibit extreme agility, continuously adapting to the latest requirements and directives. At the same time, investing in innovation remains crucial. CIFs must continuously invest in new technologies across operations, including advanced automation, deep analytics and artificial intelligence solutions, to enhance efficiency, improve client experiences and stay competitive in the rapidly evolving financial landscape. Additionally, cybersecurity remains of paramount concern, which is why at Windsor Brokers we are continuously investing in solidifying our cybersecurity defences and staying vigilant against emerging threats.

Technological trends come and go but which upcoming tech do you think will truly be a game-changer for brokers and how?

I believe that artificial intelligence will be the true game-changer for brokers in the coming years. AI has the potential to revolutionise various aspects of our industry, from enhancing customer service to optimising market research and trading strategy. One of the most significant impacts of AI will be in personalising client experiences. By leveraging AI-driven analytics, we can gain deeper insights into our clients’ trading behaviours and preferences, allowing us to offer next-level personalisation through tailored solutions. Additionally, AI can greatly enhance market research and risk management. Advanced algorithms can analyse vast amounts of data in real-time, identifying potential risks and opportunities much faster than current tools and market analytics.

From a broker’s perspective, AI-powered automation can also streamline various operational processes, thereby reducing costs and increasing efficiency. From automated compliance checks to intelligent customer support chatbots, AI empowers brokers to tackle routine tasks, freeing up our team to focus on more strategic initiatives. The future for brokers lies in embracing these technological advancements, and at Windsor Brokers, we are excited to lead the way.

(This article was first published in the October issue of GOLD magazine. To view it click here)