CI Ratings upgrades Bank of Cyprus and revises outlook to 'Stable'

10:32 - 20 December 2024

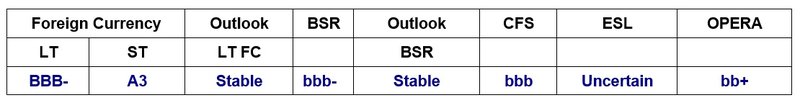

Capital Intelligence Ratings has upgraded the Long-Term Foreign Currency Rating (LT FCR) of Bank of Cyprus (BoC or the Bank) to ‘BBB-’ (from ‘BB’) and its Short-Term Foreign Currency Rating (ST FCR) to ‘A3’ (from ‘B’).

According to an announcement, at the same time, CI Ratings has upgraded BoC’s Bank Standalone Rating (BSR) to ‘bbb-’ from ‘bb’ and raised its Core Financial Strength (CFS) rating to ‘bbb’ from ‘bb+’. The ESL of Uncertain has been affirmed. The Outlook for both the LT FCR and BSR is revised to Stable from Positive.

"The two-notch upgrade of the Bank’s LT FCR and BSR is driven by both the improved CFS rating of ‘bbb’ and the higher Operating Environment Risk Anchor (OPERA) assessment of ‘bb+’. The CFS reflects the Bank’s enhanced asset quality and capitalisation metrics, which together serve to reinforce its capacity to withstand potential future shocks. These gains are supported by improved earnings quality underpinned by relatively diverse business segments within its domestic market, strong liquidity, and access to a stable and diversified funding base," the announcement said.

BoC’s BSR is derived from the CFS rating and our OPERA assessment, the latter indicating moderate risk. Economic performance in Cyprus remained positive in 2024, reflecting robust growth in the economy’s main sectors. CI expects that despite persistent external adversities, the economy will continue to perform well, in the period 2024-26, benefitting from rising domestic demand and continued investment in numerous economic activities, supported in part by Recovery and Resilience Facility (RRF) funding and foreign private capital inflows. Operating environment conditions have shown notable improvement, and banking sector strength has improved considerably in recent years but is still considered moderate as risks persist.

The LT FCR is set at the same level as the BSR as it is uncertain whether extraordinary support would be forthcoming from the authorities in the event of financial distress despite the Bank’s systemic importance. Our ESL assessment takes into account Cyprus’ implementation of the EU Bank Recovery Resolution Directive (BRRD), which makes it likely that senior creditors would be required to absorb losses prior to the Bank receiving any official support. It also factors in the moderate capacity of the government (rated ‘BBB’/‘A2’/Positive by CI) to provide timely and sufficient assistance to the Bank in the event of need.

Prudent credit risk management and remedial measures in recent years meant to deal with legacy problem loans through NPL sales have resulted in substantially reduced NPLs at BoC. As of Q3 24, the Bank’s NPL ratio stood at a low 2.7% (2.4% excluding EUR27mn NPLs held for sale – to be concluded in H1 25), with loan loss reserve coverage improving to a moderate 63% (excludes residual fair value adjustment on CPB loan book initial recognition). Overall asset quality is further supported by the structure of the Bank’s balance sheet, which includes substantial placements with Central Banks (almost all with the European Central Bank) and investments in highly rated securities; together these constituted 45% of total assets. We expect loan asset quality to remain sound in the near term, although it will remain closely linked to the performance of the local economy given the Bank’s domestic focus.

Capitalisation metrics continued to strengthen, as improved profitability coupled with low dividend payouts have meant strong internal capital generation. The latter may be somewhat constrained by a planned higher 50% dividend payout ratio in respect to 2024 earnings, but the need for additional capital has been alleviated following the rehabilitation of the loan book. Moreover, the listing of the Bank’s shares on the Athens Stock Exchange (ASE) in September 2024, along with their inclusion in two indices, has enhanced stock liquidity and visibility, which should foster greater investor interest for any future debt or equity issuances. By Q3 24, the Bank had already met the year-end 2024 MREL ratio targets set by the Single Resolution Board (SRB).

Operating profitability remained at good levels during the period, maintaining the significant gains seen in the previous year. However, income generation exhibits high reliance on interest sensitive placements with Central Banks. Going forward, the anticipated pressure on interest income due to declining rates will be partly mitigated by hedges in the form of investments in longer-dated fixed-income securities, together with greater use of longer-term reverse repo transactions, implementation of fixed-rate receiver swaps and increased fixed rate lending. We also expect non-interest income to continue making a satisfactory contribution to operating income, having formed approximately 25% in the 9 months to September 2024, the announcement also said.

The current limited avenues available to profitably deploy surplus low-cost liquidity − while maintaining sound asset quality − remains a rating challenge. Similarly, the domestic market is small and still faces certain system issues. These include the still high level of indebtedness in the country and the large stock of unresolved NPLs (albeit no longer held by local banks). Ongoing challenges in foreclosures and realisation of real estate collateral also represent risks that could impact the evolution of the Bank’s ratings. The Bank is examining possibilities for expanded international lending but we expect that any loan growth in this direction would be both gradual and in sectors where the Bank has a high level of expertise.

Liquidity and funding remain robust, with the latter supported by stable and cost-effective retail deposits. The Bank comfortably meets the Liquidity Coverage Ratio and Net Stable Funding Ratio minimum requirements, as the credit portfolio continues to represent a moderate proportion of total assets.

Rating Outlook

The Stable Outlook suggests that the ratings are expected to remain unchanged over the next 12 months. This reflects our assessment that the risk profile of BoC is likely to remain at its current level.

Rating Dynamics: Upside Scenario

An upgrade in the ratings could occur if the expansion of new business lines is substantial enough to diversify the product range, reduce sectoral concentration risk, and further enhance earnings quality, without negatively impacting asset quality. Any upgrade to either the ratings or the outlook would also require an improvement in our OPERA assessment.

Rating Dynamics: Downside Scenario

Though unlikely, the Outlook on the Bank’s LT FCR or BSR could be revised to Negative (or the ratings lowered) if the Bank’s financial metrics weaken considerably or our OPERA is revised downwards.

Ratings