Cyprus’ non-dom regime in the spotlight: Remarkable turnout at IMH and Invest Cyprus conference in London (pics)

12:03 - 04 December 2024

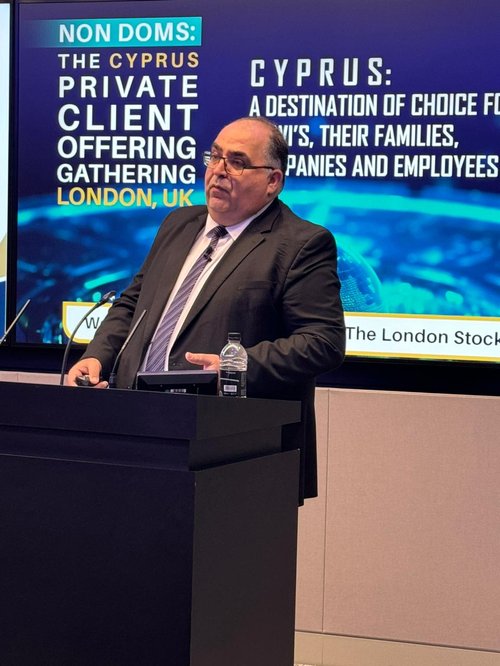

The conference "Non Doms: The Cyprus Private Client Offering Gathering 2024" has kicked off with impressive participation in London, organised by IMH and Invest Cyprus.

The event is being held at the historic London Stock Exchange, attracting leading professionals from the fields of wealth management and international investment.

With more than 150 participants, the conference is hosting over 120 professionals from the UK, including lawyers, accountants, private bankers, and family office managers. Additionally, more than 30 experts from Cyprus are actively participating, strengthening ties between the Cypriot business community and international investors.

Focus of the conference

The conference revolves around the theme “Cyprus: A Destination of Choice for High Net Worth Individuals (HNWIs), their Families, Companies, and Employees”, showcasing Cyprus’ multiple advantages for non-doms. Presentations and interactive discussions are focusing on:

- The attractive tax regime.

- Wealth protection solutions.

- Opportunities for professional presence on the island.

Marios Tannousis, CEO of Invest Cyprus, and George Pantelis, former General Director of the Ministry of Finance, highlighted Cyprus’ strategy to attract international investors and businesses. Practical solutions for those choosing Cyprus as their new jurisdiction were also emphasised.

Networking and opportunities

The event will conclude with a networking brunch, offering participants the chance to exchange ideas and explore new avenues for collaboration.

A major opportunity for Cyprus

This conference comes against the backdrop of a significant opportunity for Cyprus to attract high-income and high-net-worth individuals from around the globe. This could bring substantial benefits to the Cypriot economy, enhancing its status as a prime destination for investment and beyond.

A huge opportunity has arisen due to the recent decision by the UK government to abolish its non-dom tax regime. This regime, in place for many years, allowed non-UK nationals, primarily high-income earners or inheritors, to establish tax residency in the UK.

According to the UK Labour government’s latest decision, announced in late October by Finance Minister Rachel Reeves during the presentation of the UK budget, the current non-dom regime will be abolished in April 2025. It will be replaced by a new system based on residency, with internationally competitive arrangements for temporary UK residents.

Cyprus as an alternative

Cyprus emerges as an attractive alternative, offering its own competitive non-dom regime for those seeking a new jurisdiction. This makes the country a compelling choice for individuals looking to benefit from favourable tax conditions while enjoying a high-quality lifestyle.

The conference is organised by IMH in partnership with Invest Cyprus and the Cyprus Investment Funds Association (CIFA), and sponsored by Alpha Bank Cyprus Ltd, Athlos Capital, Bank of Cyprus, Domenica Group, Limassol Greens, PwC Cyprus, Pyrgou Vakis LLC, Totalserve Group, PGE&Co and Tsirides Law.