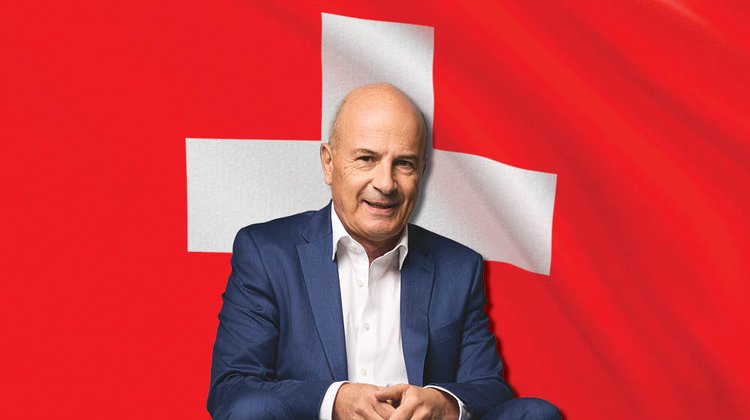

Christoph Burgener: Further collaboration possible between important financial centres Switzerland and Cyprus

07:18 - 19 March 2024

Swiss Ambassador Christoph Burgener recently talked about how his country, a long-established financial centre, is navigating today’s challenges, especially after a turbulent year that saw UBS acquire its domestic rival Credit Suisse.

Speaking as part of the GOLD magazine’s February Cover Story, featuring 11 heads of diplomatic missions in Cyprus, he also examines the nature of economic and trade relations between Switzerland and Cyprus.

Last year, the Swiss banking industry experienced a momentous event with UBS’ acquisition of Credit Suisse. UBS now manages a staggering US$5 trillion in assets but what does this mean for Switzerland’s economy? And what steps are being taken to ensure that a collapse like that of Credit Suisse doesn’t happen again?

Let me first note that Credit Suisse complied with the regulatory requirements for liquidity and held comfortable liquidity buffers in summer 2022. Its problems arose in a range of business areas and due to various risk types. In almost all of these, serious deficiencies in risk management played a role and this led to a loss of confidence in the bank and to rapid, extensive liquidity outflows that were exacerbated by digital communication channels (“digital bank run”) and ultimately brought the bank to the brink of insolvency. The government-backed takeover of Credit Suisse by UBS in March 2023 helped safeguard financial stability at home and abroad and minimised the cost to the Swiss economy and taxpayers. The financial centre was thus able to demonstrate its strength in a very difficult situation, despite the painful loss of a major bank with a long tradition. A Parliamentary Commission of Inquiry is currently examining the legality, appropriateness and effectiveness of the management by the competent authorities and bodies in the context of the Credit Suisse crisis. This Commission will draw up a report for Parliament on the results of its investigation. In spring 2024, the Swiss government will present a comprehensive analysis of the “too big to fail” rules and regulations and will also identify any need for action to further develop the stability rules. I finally have to underscore that the Swiss banking centre is developing well, with more than 200 banks, including almost 100 foreign banks. Switzerland continues to be one of the world’s leading financial centres. The existing national and international regulations to enhance financial stability have largely proved their worth.

Much has been made of sustainable financial investments in recent years, with significant growth in the space followed by questions over the definition of such investments, as well as accusations of ‘greenwashing’. Switzerland’s Federal Department of Finance has already said that it will be drafting legislation on the issue. Due to the country’s importance as a leading financial centre, its regulatory approach to ESG investment will doubtless have a global impact on the financial industry. What can we expect in terms of the content of such legislation, and when?

Switzerland, a country renowned for its commitment to quality and excellence, is translating these values into sustainability efforts. Swiss voters have endorsed a new law aimed at expediting the nation’s transition from fossil fuels to renewable energy sources, with the goal of achieving net-zero emissions by 2050. The Swiss government also sees sustainable finance as a major opportunity for the Swiss financial centre. Switzerland aims to be a global leader in this field. Since the beginning of this year, large Swiss companies are obliged to report publicly on the climate issues and risks associated with their activities. Switzerland is thus one of the first countries to implement international recommendations in a binding manner. Switzerland was also the first country to develop a set of criteria that can be used to show in a transparent and comparable way how climate-friendly financial products and services are – the Swiss Climate Scores. With regard to the risk of ‘greenwashing’, the financial sector is currently working on binding rules. At the same time, the Government will develop state regulation by mid-2024 if the financial sector does not develop effective self-regulation by then. For the Government, one thing is crystal-clear: customers must not be misled about sustainability credentials of financial products and services. I am firmly convinced that an excellent reputation is essential for the long-term survival of an international financial centre.

In October 2021, over 140 countries, including Cyprus and Switzerland, agreed that large multinational enterprises with a turnover of €750 million or more should pay at least 15% tax on their profits. What is the implementation status of this agreement in Switzerland?

In the referendum in 2023, Swiss voters welcomed the implementation of the OECD/G20 project on minimum taxation with 78.5% voting in favour and 21.5% voting against. In December 2023, the Federal Council, our Government, decided to implement the minimum tax rate with the introduction of a supplementary tax in Switzerland from 1 January 2024. It will thereby prevent the erosion of the Swiss tax base in favour of other countries and create stable framework conditions.

In 2021, the total trade volume between Switzerland and Cyprus was US$121.7 million, with Switzerland exporting far more to Cyprus than the other way around. What sectors do our two countries trade in? Are there other areas of trade that can be explored?

When analysing bilateral trade relations between Cyprus and Switzerland, it is worth keeping proportions in mind. The Republic of Cyprus covers a quarter of the surface area of Switzerland and has a population of just under one million. Switzerland has a population of around nine million. Given these dimensions, it is easy to understand that the scope of bilateral economic relations between these two small countries with limited numbers of potential customers is not very significant overall. Switzerland imports goods from Cyprus to the value of around €10 million and exports goods to the value of around €120 million.

The lion’s share of exports and imports is made up of consumer goods such as watches, food and pharmaceutical products. There are no significant production facilities of Swiss companies in Cyprus. Financial institutions based in Switzerland – two well-known new companies were added in 2023 – and management companies in the shipping sector can be found in Cyprus. Bilateral trade often takes place via Greece, where branches of Swiss companies cover the Cypriot market. For this reason, the visibility of Swiss industry is low, except for consumer goods on supermarket shelves. Everybody in Cyprus knows the famous watch brands like Rolex, Jaeger-LeCoultre, Longines, Omega, Cartier, IWC, Zenith and Hublot to name but a few. Swiss cheese and dairy products as well as Swiss chocolate are also very popular in Cyprus, while Swiss pharmaceutical products have a large impact in the health and well-being sector. When it comes to imports, pharmaceutical products are high on the list. For Cypriot agriculture, I see increasing export opportunities for halloumi, which is becoming more and more popular in Switzerland. However, the focus of economic relations between our two countries is on financial services, where Switzerland and Cyprus can inspire each other, particularly with regard to the latest developments.

Roughly 40,000 Swiss tourists visit Cyprus each year. What do the Swiss find attractive about Cyprus as a tourism destination? Are there any initiatives underway to further promote tourism and foster enhanced collaboration between the two nations in this pivotal sector?

Tourism is an important economic factor for Switzerland (7.6% of GDP) and for Cyprus (20% of GDP). More and more Cypriots are discovering Switzerland for summer or winter holidays. Whether cycling, hiking, skiing or for family holidays, every guest will have an unforgettable experience in Switzerland. Almost daily direct flights (3 hours, 20 minutes) between our countries boost the flow of tourists in both directions. Cyprus is becoming more and more popular with Swiss tourists and, in 2023, I understand that more than 60,000 travelled to Cyprus. Although they are not the largest tourist market, they are traditionally among those that spend the most per day during their stay. Swiss tourists are thus attractive guests all over the world. Not much promotion has to be done for Cyprus as a tourist destination, as the spectacular beaches, wonderful mountainous landscape, archaeological parks and monuments and the unique hospitality of the Cypriot people speak for themselves. My family and friends visit me time and time again. In this context, let me mention that Swiss Hotel Management schools are known for their high-quality hospitality education, offering programmes in hotel management, the culinary arts and business. These schools are recognised for their emphasis on practical training and international exposure, providing students with a solid foundation for promising careers in the hospitality industry.

What other industries exhibit promise in furthering collaboration between Cyprus and Switzerland?

When I started my assignment in Cyprus in 2022, together with my experienced Embassy team I evaluated the economic landscape of my new country of residence. Then we identified how Switzerland can benefit from the strengths of Cyprus and whether Switzerland can find attractive business partners in Cyprus. As Switzerland and Cyprus are important financial centres, we can extend our cooperation in this sector. Not only B2B but also between governments. We are facing the same challenges to keep our financial centres sustainable and clean. As Ambassador of Switzerland, I have to promote Switzerland as a tourist destination and I am sure that Switzerland can be more developed here in Cyprus as a tourist and tourism-education destination. On the other side, I envisage more close cooperation between our two countries in the public health sector. Swiss professors are starting to be active in the fields of psychiatric care and emergency medicine and Swiss hospitals work with universities in Cyprus. I also see potential for cooperation in the area of public transport. To put it in diplomatic terms, there is room for improvement in the expansion of public transport in Cyprus. Switzerland has a very well-developed transport system and a competitive transport industry. I am convinced that cooperation would make sense here. We are working on it. The Cyprus Swiss Business Circle (CSBC), which includes well-known personalities from the Cypriot business world, is constantly exploring more bilateral business opportunities.

What can you tell us about the number of Swiss citizens residing in Cyprus and their main occupations?

There are around 600 registered Swiss nationals living in Cyprus and, overall, the number is probably slightly higher. The majority are pensioners who enjoy the high quality of life here. The climate, the landscape, the sea, etc. are all very favourable. In recent years, however, more and more Swiss have settled here for professional reasons. Young Swiss professionals are increasingly present in the financial sector and in technology start-up companies in particular. I am in contact with a lot of Swiss living in Cyprus. All my fellow citizens appreciate the local living conditions and the extraordinary hospitality of the Cypriots.

How do you perceive Cyprus’ lifestyle and culture? Are there specific aspects of local life that have left a lasting impression on you during your time here?

I could list numerous reasons why I like being in Cyprus so much. The mentality of the people, their generosity and hospitality make Cyprus a dream destination. An entertaining evening among local friends in a taverna is always A wonderful experience. As a passionate skier, I can’t wait to try winter activities on the Troodos mountains. Coming from a landlocked country, I enjoy the wonderful beaches of course. I have to stop talking about the island’s excellence, otherwise people will think I’m never in the office! I do hope to be able to give something back by intensifying our bilateral relations. And I still believe that the Swiss federal system could be an inspiring model for the peaceful reunification of the island, which would also be a win-win in an economic sense. I will not stop praising the idea of this system all over the island.

(This interview first appeared in the February edition of GOLD magazine. Click here to view it.)