The Games Fund and GEM Capital rank among InvestGame’s Most Active Gaming VC Funds

07:08 - 29 July 2024

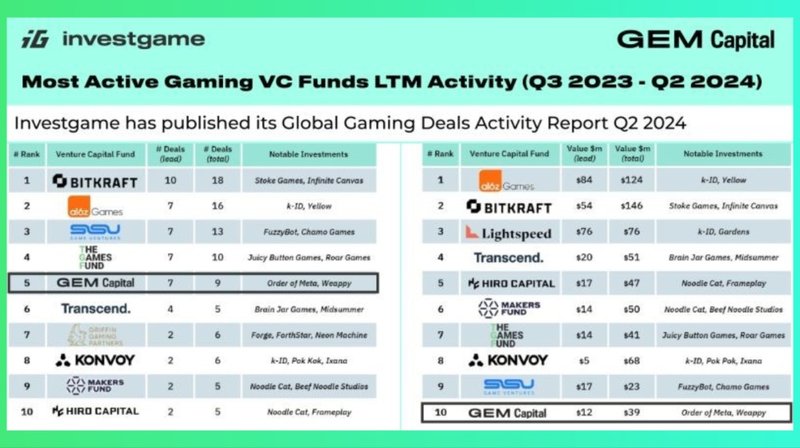

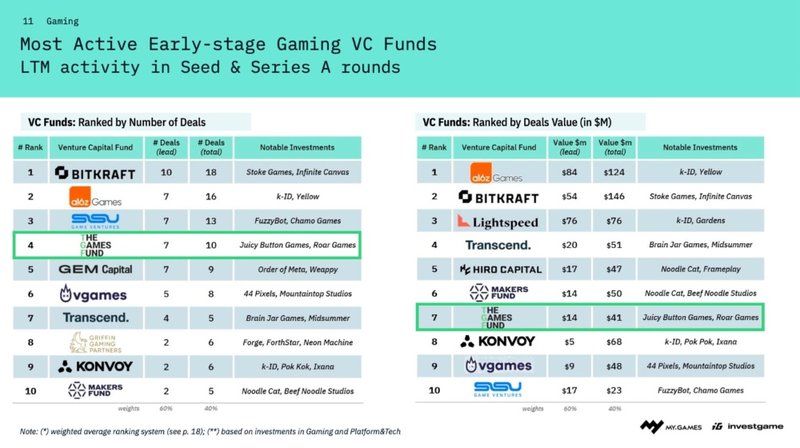

Cypriot-based venture capital (VC) firms GEM Capital and The Games Fund have been recognised as two of the Most Active Gaming VC Funds by InvestGame for Q3 2023 - Q2 2024.

More specifically, The Games Fund and GEM Capital have ranked 4th and 5th respectively (in number of deals) on InvestGame’s list of Most Active Gaming VC Funds, having finalised 10 and 9 deals (respectively) in total.

In terms of the deals' value, The Games Fund ranked 7th with a total value of $41m and GEM Capital 10th with a total value of $39m.

Maria Kochmola, Co-founder and Managing Partner at The Games Fund, stated: “The last 12 months were among the busiest in terms of TGF investment activities. We are confident that now is a very good time to plant seeds that will be nourished in the coming years. There are amazingly talented teams in the industry, and we are extremely lucky to partner with the best talent out there.”

GEM Capital said on its LinkedIn: “This recognition is a reflection of our commitment to the gaming industry and our belief in the power of games to connect people and create unforgettable experiences. Looking ahead, we're excited to continue supporting innovative gaming companies and driving the future of gaming. Thank you to our team, portfolio companies and investors for their support.”

The InvestGame Q2’24 Global Gaming Deals Report provides a comprehensive analysis of the current market dynamics within the gaming industry.

According to the report, the games industry remains resilient amidst evolving challenges. Ongoing layoffs, studio closures, volatile gaming stock prices, and project cancellations dominate current gaming news headlines.

In Q2 ’24, the industry saw 166 closed deals totalling $4.1b, marking an increase in both deal value and volume. This uptick suggests a gradual recovery from recent lows, reflecting renewed investor confidence and stability returning to the market.

The key contributor to Q2 ’24 was Private Investments, which attracted $1b across 116 rounds, indicating a stabilisation phase following post-pandemic growth. M&A activity showed a slight growth in terms of the number of deals, with 37 announcements, while the total amount remained relatively stable at around $0.5b across all deals.

Access the full report here

Read more: The Games Fund invests US$3 million in newly-founded Cyprus-based mobile game company

Read more: Gem Capital invests $5m in Weappy, VEA Games and Game Garden