How Have Geopolitics Impacted Markets and What Should Investors Do?

Anastasia Anastassiades 09:37 - 30 July 2024

Although both gold and oil prices increased immediately after the October attacks in Israel (the expected reaction of investors in times of crisis), it is gold that has rallied the most since then. But can we attribute all the moves in the gold price to geopolitics? Global central banks have increasingly wanted to diversify away from the US dollar and this has also helped gold prices.

Oil markets have been well supplied and, indeed, prices fell in early December. Before October there had been signs that high prices were causing ‘demand destruction’ and prices had been falling from September. They rose through Q1 2024 before dropping back again after the early April peak which occurred before the Iranian missile and drone attack on Israel.

Yields briefly fell following explosions in central Iran. This shows that markets still perceive Treasuries as a go-to safe haven in times of stress, even though strategically there has been a shift towards other diversifiers such as gold. However, year-to-date, Treasuries have struggled repricing the likely path of the Fed Funds rate, and concern about the excess supply of government bonds has also likely hurt global yields.

Markets are not pricing in the possibility that recent geopolitical events will spiral into a global conflict. The VIX briefly spiked immediately after the Isfahan strikes became known. The spike, when looked at on daily close data over the last 25 years, is hardly visible.

Although market reaction to this latest shock has been subdued, building resilience into portfolios should be a matter of strategy rather than a tactical decision made after events. Diversification across more asset classes is one way to build resilience. With correlations between bonds and equities being positive in recent years, relying on government bonds alone might not provide as much diversification as investors hope.

What is driving markets?

If it’s not geopolitics that is solely driving markets, what is? Markets are still grappling with the impact of US growth remaining above long-term trend. Although growth has slowed from over 4% in the second half of 2023, demand growth will likely be close to 3% in the first half of 2024. Other global economies also look to be bottoming out; Germany and the UK experienced technical recessions in 2023 but all of Europe now looks to be doing better.

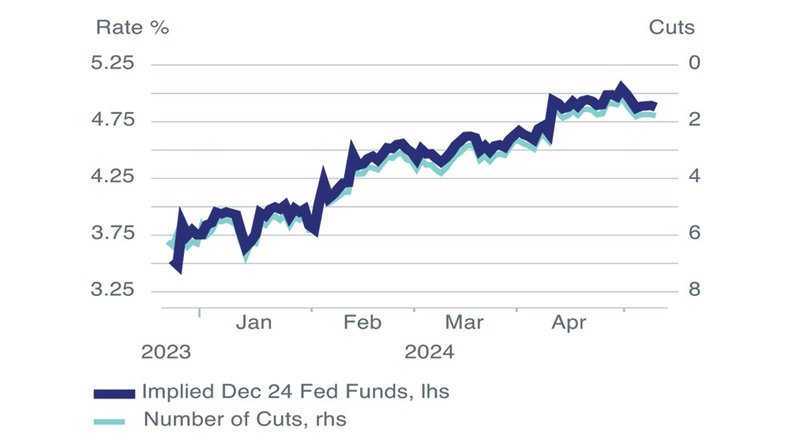

Implied Fed rates versus the current policy rate - Source: Macrobond, Bloomberg

Initially, equity markets this year have focused on the positives of this higher growth creating bigger profits and fewer chances of credit problems, but rates markets have also shifted in response to the higher growth, and with a lag that we think has impacted equities.

At the start of the year, markets were pricing in the potential for around seven US rate cuts throughout 2024. Now they’re pricing in around two and a chance that there won’t be any cuts at all.

Whilst the higher profits story is priced in, it doesn’t seem like the higher rates for longer story is. Higher yields have driven the expected return on government bonds by over three percentage points over the last few years.

However, the expected long-term return on equities has only risen slightly, suggesting that the equity risk premium over bonds, the additional return that investors can expect to earn for investing in equities over bonds, is compressed by historical standards. If markets choose to focus on this, then this could still create a headwind for equity market performance, even if global geopolitical and economic risks are avoided.

Making portfolios more resilient

How should investors make portfolios more resilient? More asset classes will typically add more diversification, and less reliance on public equities for generating returns. We also think that there are some asset classes, such as diversifying hedge funds and active commodity strategies, which can take advantage of markets not pricing geopolitical scenarios efficiently. What is right for each investor will be client-dependent. The biggest risk of over-diversification is that it reduces a portfolio’s returns without meaningfully reducing its risk. Each new investment added to a portfolio lowers its overall risk profile. Simultaneously, these incremental additions also reduce the portfolio’s expected return. An investor can reach a point where the benefit of risk reduction from each new addition is smaller than the decrease in expected gains.

Thus, there’s no incremental benefit to adding that investment. It would be better to sell a lower-conviction idea and replace it with this new one than add it to the portfolio since there’s no incremental benefit.

Opinion article by Anastasia Anastassiades, Associate Partner, AON Wealth Solutions

(This article first appeared in the 2024 edition of The Cyprus Journal of Wealth Management, commissioned by Eurobank Cyprus and published by IMH. Click here to view the article. Click here to view the entire magazine online.)