Ongoing initiatives by the Cyprus Securities and Exchange Commission to enhance Financial Literacy

Elena Karkoti 12:12 - 20 September 2024

Financial literacy empowers citizens to manage their money effectively and make sound decisions regarding their financial activities. Promoting financial literacy in our country has been a longstanding strategic goal for CySEC, which has consistently supported the view that financial education should be integrated into the core educational curriculum.

CySEC, therefore, welcomes the recent decision by the Ministry of Education, Sports, and Youth to introduce a financial education program for 3rd-grade secondary school students starting in the current academic year as a very significant step. CySEC applauds the Minister of Education for this decision and, more importantly, its intention to expand the program to include a dedicated weekly subject within the school curriculum.

It is crucial for children to understand basic principles and functions related to money management. For example, they should be able to create a simple budget with their expenses and income, calculate how much and for how long they need to save to purchase something they desire, and recognize the importance of maintaining an emergency fund to cover unforeseen expenses.

Young people also need to be able to identify investment risks, particularly online and on social media platforms with which they are so familiar. The creation of new, complex financial products and services, driven by rapid technological advancements and the swift changes in capital markets, makes early financial education essential. There is evident interest from young people. During informational lectures we organized across all educational levels in Cyprus—from elementary schools to universities—on the occasion of Global Money Week 2024, we observed enthusiastic participation from students, who actively engaged by asking questions and sharing their views.

Clearly, financial education goes beyond simply introducing a subject in secondary education. The need for public financial education is systematically highlighted by European and international organizations. Research conducted by CySEC, and other entities, has shown relatively low levels of financial literacy among the general population in Cyprus.

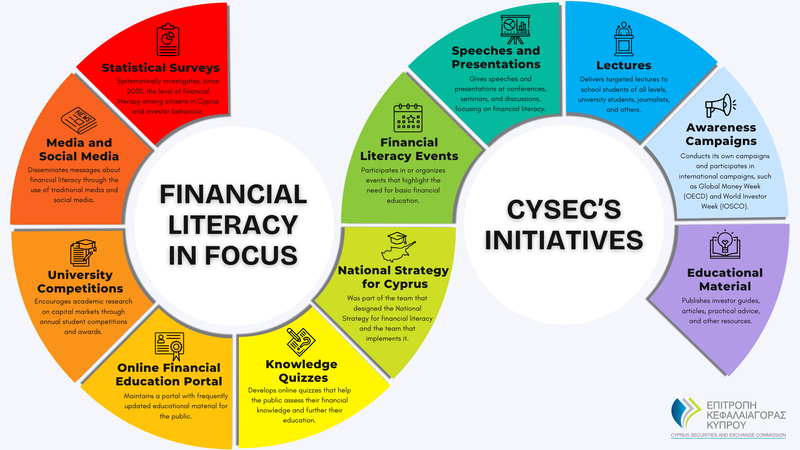

CySEC will continue to undertake further initiatives aimed at the public at large, regardless of age. Among other things, CySEC maintains an online Financial Education Portal on its official website, regularly updated with educational material in simple and understandable language (investor guides, articles, practical tips, warnings, manuals, etc.). The portal also features CySEC’s online quiz, an enjoyable educational tool where the public can assess their knowledge in investing and simultaneously enhance their understanding.

CySEC has been actively involved in designing Cyprus’s National Strategy for Financial Literacy and works alongside other organizations and authorities to implement this strategy through the Committee established for this purpose. It conducts its own awareness campaigns on current issues that it believes the public and investors need to be informed about. Additionally, CySEC actively participates in international awareness and educational campaigns, such as Global Money Week organized by the Organisation for Economic Co-operation and Development (OECD) and World Investor Week organized by the International Organization of Securities Commissions (IOSCO). During this year’s World Investor Week (October 7-14), CySEC plans to focus its activities on the need for timely financial education for children and teenagers, as well as the risks associated with online and social media environments.

To reach a broader segment of the population with its messages, CySEC conducts speeches and presentations at conferences, seminars, and roundtable discussions on public education, and participates in or organizes events that highlight the need to strengthen financial literacy of the public. In order to enhance or deepen students' knowledge and encourage academic research on topics related to investment and capital markets, CySEC organizes an annual student competition and awards two students from universities in Cyprus.

In all financial education campaigns and initiatives, efforts are made to reach the widest possible audience through media presentations. Furthermore, social media platforms are fully utilized to better promote and disseminate messages and to inform young people and individuals who choose to stay informed via online sources.

CySEC’s actions and initiatives in financial education, and the collaborative efforts with other entities in this field, aim to protect investors and promote the financial well-being of the public in general. We believe that with proper education and timely access to relevant information, we can create a new generation of citizens able to make sound financial decisions and tackle the many challenges of the modern economy.

*Elena Karkoti is a Senior Officer in the Strategy, International Relations, and Communication Department of the Cyprus Securities and Exchange Commission and is responsible for Public Financial Education.