CySEC launches new campaign to tackle rising impact of finfluencers on financial markets, and protect investors

Press Release 13:49 - 27 September 2024

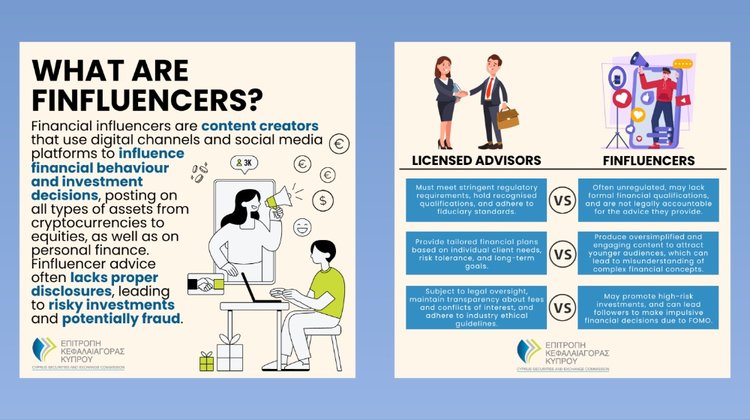

The Cyprus Securities and Exchange Commission (CySEC) has launched a new targeted investor protection campaign through the issuance of a Warning, an Investor Guide, and a series of informative social media posts, to tackle the increasingly intense influence of social media and the so-called financial influencers (widely known as “finfluencers”) on financial markets and protect the investing public.

Individuals and entities that directly or indirectly give advice or ideas about financial products or services to media outlets, including on social media, are being warned today that they may be violating the EU Market Abuse Regulation. Firms that are working with finfluencers need to take more responsibility for how their financial promotions are being communicated, the regulator said. CySEC expects that any recommendations and other information related to investments are neutral, clear and disclose any conflict of interest. Individuals that use digital channels and social media platforms to influence financial behaviour and investment decisions (financial influencers or finfluencers) must also comply with the criteria for investment advice under the regulatory framework.

CySEC has also enhanced its financial literacy campaign by launching an Investor's Guide entitled "Unveiling the World of Finfluencers" to empower investors to critically evaluate financial content online. This explains how finfluencers work, and the potential risks associated with following unauthorised advisors on social media.

In some cases, investors have lost money, accumulated huge debts, or fallen victim to fraud.

Launching the campaign, Dr. George Theocharidis, the CySEC Chairman, said:

“Social media plays a very important role in companies' marketing strategies and that's why we see everyone from celebrities and sports stars and to people who have no professional knowledge about investments, giving advice and promoting complex products.

“Unfortunately, the lack of formal financial education and the rise of digital platforms has seen finfluencers fill a gap that has increased the risk of people making bad investment choices. Although there are also legitimate sources for investments on the internet, a great deal of content is putting investors at risk.

Through this campaign, we want to warn the investing public to be careful of the investment advice they receive from influencers and be suspicious about their motives. At the same time, we expect regulated entities using this kind of marketing to take more responsibility for these promotions, and ensure they are not misleading and comply with the regulations. CySEC has already introduced monitoring tools to detect online promotions and advertising that does not follow the rules. As a regulator, we will not tolerate firms that spread misinformation, either directly or indirectly, or encourage people to invest without properly explaining the risks.”

More information and educational material are available on the Financial Education Hub on the CySEC website.