The banking sector at a crucial crossroads: Neobanks and the great challenge for traditional banks

Donna Kaparti 08:11 - 21 January 2025

In the modern era, the banking sector is in constant transformation. Technological progress, globalisation and changing customer needs are shaping new trends and practices.

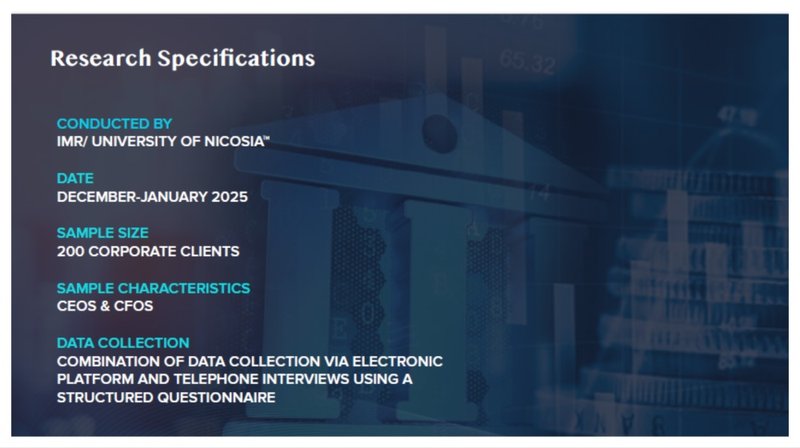

Valuable data for understanding the current situation and the sector's prospects is provided by research, such as that presented by the CEO of IMR/University of Nicosia, Christina Kokkalou, at the recent 12th Banking Forum & FinTech Expo .

The survey included interviews with 200 CEOs and CFOs of companies in Cyprus, revealing important aspects about satisfaction, expectations and opportunities in the corporate banking sector.

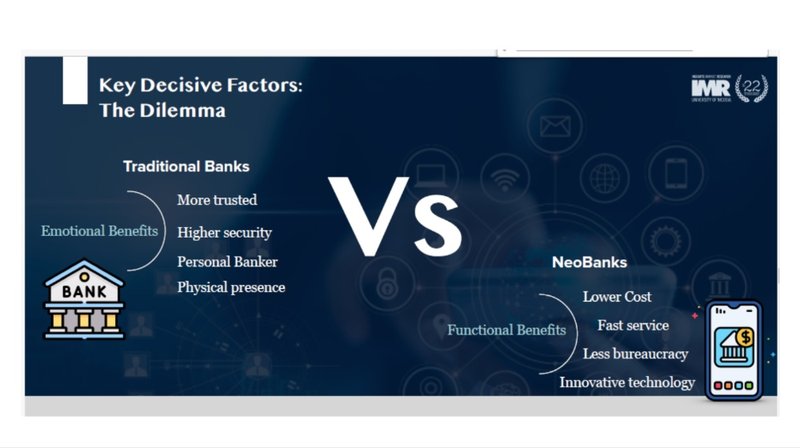

The research demonstrated - among other things - the growing preference for speed, flexibility and transparency in banking services, elements that neobanks have placed at the centre of their activities.

As the research findings show, traditional banking institutions are now faced with the challenge of modernising their structures and services in order to compete with the technologically advanced solutions of neobanks.

One of the main conclusions is the fact that businesses are increasingly turning to models that combine the security of traditional banks with the flexibility of fintech companies.

At this pivotal crossroads, the need for innovation and adaptation emerges as being vital for the evolution of banking organisations.

The current picture of corporate banking

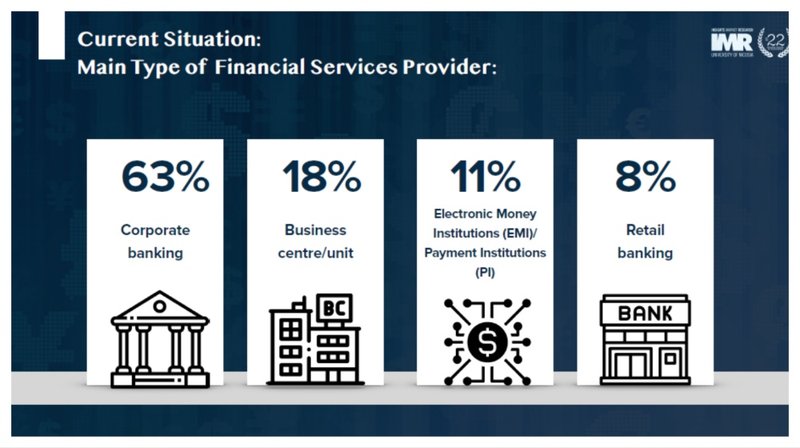

The majority of companies, approximately 63%, mainly use corporate banking services, while 18% target business centres and 11% target electronic money institutions.

87% of businesses work with more than one banking provider, with 45% working with at least three banks. A strategy that reflects the need for risk diversification and access to specialised services.

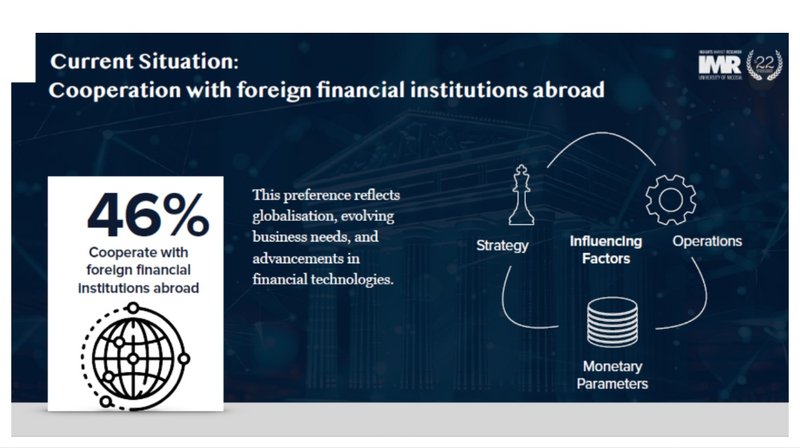

Furthermore, 46% of companies collaborate with foreign financial institutions, reinforcing dependence on international services in a globalised environment.

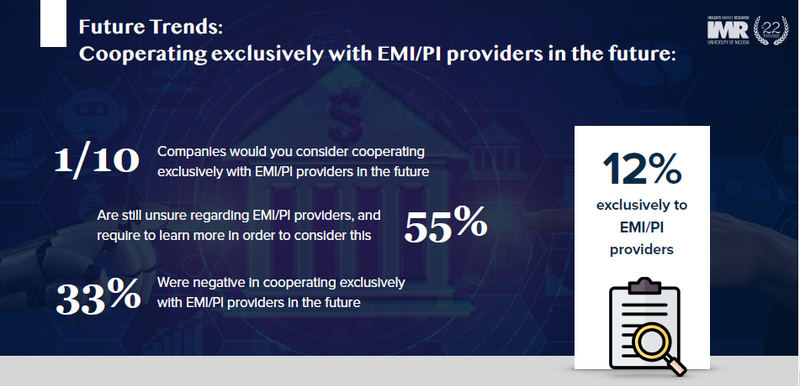

Also noteworthy is the willingness of 12% of companies to collaborate exclusively with EMIs/PIs in the future, while a significant percentage is considering using them in combination with traditional banks, seeking greater flexibility and innovation.

Customer Satisfaction: What Works and What Doesn't

The survey revealed high levels of satisfaction with the product range (78%), customer service (76%) and digital platforms (72%).

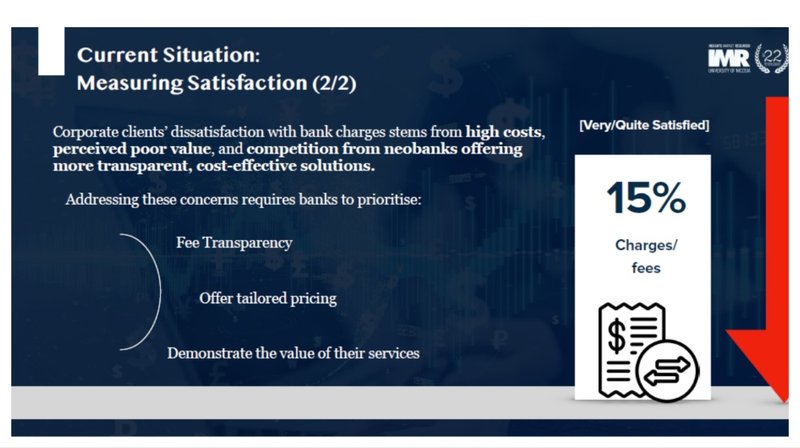

However, only 15% of customers say they are satisfied with charges and fees, reflecting increased pressure from neobanks.

Speed of service (48%) and reduction of bureaucracy (44%) are cited as important factors in choosing a financial provider, highlighting the importance of flexibility and immediate response.

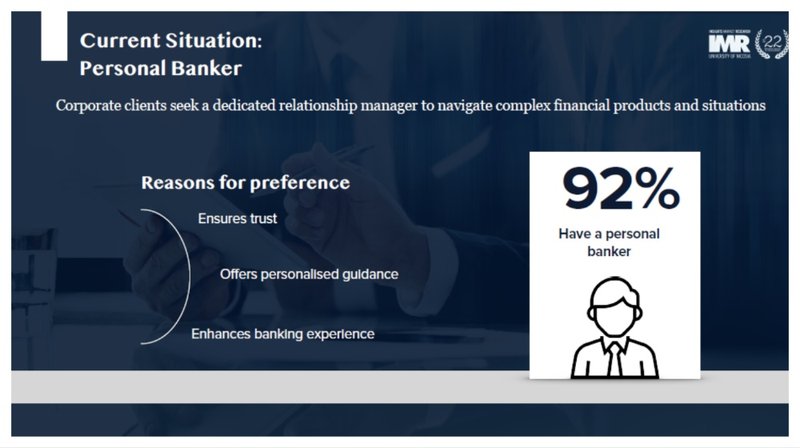

The dynamics of the personal banking relationship

The personal relationship with a banker remains crucial for trust and satisfaction. 92% of businesses have a personal banker, while 50% communicate with them at least once a week.

Future investments and prospects

76% of companies plan to invest in technology, recognising the importance of digital transformation for growth.

Furthermore, 67% intend to invest in the training and development of their staff, while 45% are oriented towards recruiting new executives.

In the financing sector, 48% of companies declare they are open to receiving international loans, while 32% are considering the possibility of financing through alternative methods.

The survey also showed that 33% of businesses intend to invest in new products and services, 25% in international markets and 24% in new local markets.

Challenges for the future

The research highlighted a banking industry that is at a crossroads. The traditional banking sector is being called upon to adapt to new demands, offering even more transparency, faster service and innovative solutions.

Businesses require services that will not only support their growth, but also enhance their competitiveness in an ever-changing business environment.

Neobanks continue to gain ground, taking advantage of their technological superiority and flexibility.

Traditional banks are being called upon to immediately respond, adopting innovations that will ensure their adaptation to the modern needs of customers and the maintenance of their leading position.

The 12th Banking Forum & FinTech Expo was presented by Logicom Solutions.