Local VC funds and gaming companies involved in the top gaming deals of 2024

Jacqueline Theodoulou 07:00 - 27 January 2025

Cyprus’ games sector is going from strength of strength, with local venture capital funds and gaming companies featuring prominently in InvestGame’s latest report on the biggest deals of 2024.

According to the InvestGame 2024 Gaming Deals Report, M&A activity shifted from opportunistic, short-term “arbitrage” deals to more strategic, long-term, and objective-driven transactions last year, and the local gaming industry was there for it.

Miniclip acquired Easybrain for $1.2b in second largest deal

Back in November, Miniclip announced that it acquired Cyprus-based mobile games developer Easybrain from Embracer Group for $1.2b, making it the second largest deal of 2024, according to the report. The ranked second under the “Most notable M&A deals in 2024”.

Easybrain had been purchased by Embracer in 2021 for $640m plus an additional $125m in potential earnouts. The acquisition is expected to close during the first months of 2025.

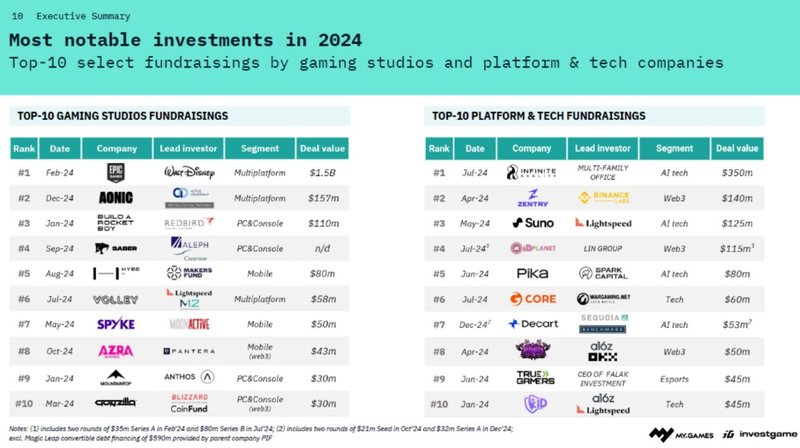

Wargaming led investment in Gcore raising $60m

In another major deal, Nicosia-based Wargaming.net ranked sixth under the “Most notable investments in 2024 – Top 10 Platform and Tech Fundraisings” section, for leading an investment in Gcore, an edge AI, cloud, network, and security company founded in 2014 in Luxembourg.

Back in July, Gcore said that it raised $60m in series A funding, in an investment that was led by Wargaming, with participation from Constructor Capital and Han River Partners.

With a global network of over 180 edge nodes across six continents, including 25+ cloud locations, Gcore said it would use the series A raise to fund further AI innovation in Gcore solutions and technology, including investing in cutting-edge AI servers powered by NVIDIA GPUs.

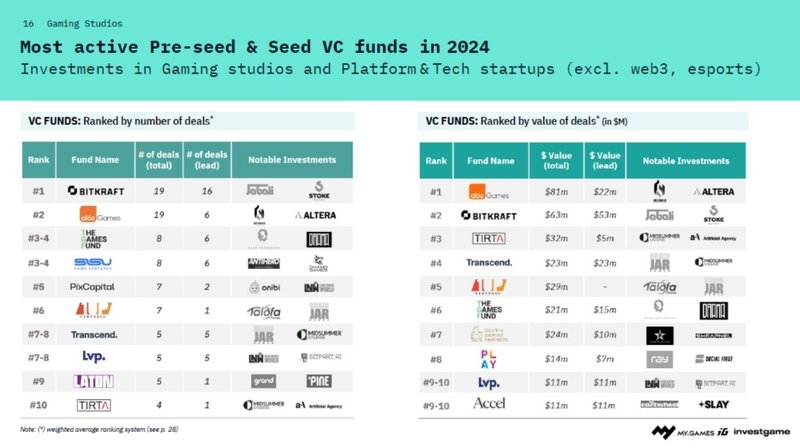

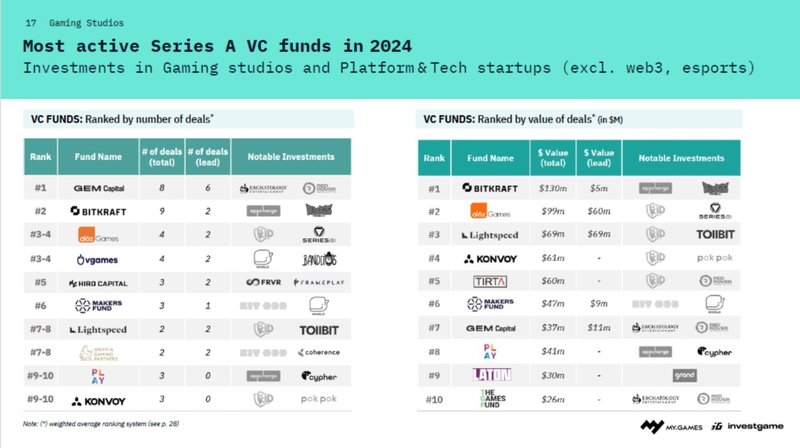

The Games Fund and GEM Capital among most active VC funds

Cyprus-based venture capital funds The Games Fund and GEM Capital ranked among the most active in 2024.

GEM Capital ranked first under the “Most active Series A VC funds in 2024” section, in terms of number of deals, having clinched eight in total, the most notable being Eschatology Entertainment and Red Rover. In terms of value it ranked 7th with €37m, while The Games Fund ranked 10th with €26m.

As for the “Most active Pre-seed & Seed VC funds in 2024”, The Games Fund ranked 3rd in terms of numbers with eight deals, and 6th in terms of value ($21m).

The main findings of InvestGame’s 2024 Gaming Deals Report

M&A activity shifted from opportunistic, short-term “arbitrage” deals to more strategic, long-term, and objective-driven transactions, with deal-making activity remaining above pre-COVID levels.

Amid a stricter environment, many strategic players streamlined pipelines, announced layoffs and offloaded non-core assets while doubling down on core businesses (e.g., Embracer Group, MTG, Take-Two, Aristocrat).

M&A activity spanned all segments, with the work-for-hire sector taking center stage, highlighted by the $2.8B Keywords buyout and the sale of 16 other WFH studios.

In an investor-friendly climate, private equity firms seized the opportunity to acquire companies (e.g., Keywords, Jagex, Private Division) and provide growth capital (e.g., Aonic, Saber).

Many VCs shifted their focus from funding game development studios to investing in platform and tech startups, while corporate venture funds accelerated their investments in gaming studios.

IPO activity remained low (e.g., Shift Up, Winking Studios) as most companies delayed going public amid macro uncertainty.

The report’s 2025 Outlook

InvestGame anticipates sustained M&A momentum to match or slightly exceed 2024 levels, driven by several factors:

﹣ Lower interest rates, stronger public markets, and significant cash reserves are expected to fuel more acquisitions by public strategics.

﹣ PE firms dedicating more attention to gaming opportunities and easing borrowing costs will likely result in more buyouts, PE-backed acquisitions, and PE-led investments.

It also expects VCs to deploy more funds into platform and tech startups, leaving corporate and strategic venture arms to step up investments in game developers.

Although high-profile gaming teams will still command strong valuations, such deals are expected to be less frequent, said InvestGame. So it expects renewed enthusiasm for crypto and rising interest in AI-driven solutions will create fresh investment opportunities in web3 and tech-centric ventures.

And finally, it anticipates that a more favourable market environment could reopen the IPO window, with some private companies pursuing the public route. At the same time, public companies may increasingly rely on PIPEs to finance future growth.

(To access the InvestGame 2024 Gaming Deals Report click here.)