AstroBank announces €41.8m profit in Group Financial Results for 2024

10:11 - 16 April 2025

“2024 has been a remarkable year for AstroBank. Systematic efforts over the past few years, towards a focused business model, streamlined operations, reshaping and derisking our balance sheet, together with favorable interest rates and macroeconomic environment, contributed to delivering a strong financial performance," Aristidis Vourakis, CEO, AstroBank has said in a statement announcing the Group's Financial Results for the year ending 31 December, 2024.

"The decisive actions of AstroBank’s management and personnel over last four years culminated in the successful transaction, announced on 27 February 2025, for the combination of AstroBank’s operations with those of Alpha Bank Cyprus to create an enlarged banking group in Cyprus. We are looking forward to the successful completion of the transaction and the enlarged Bank’s contribution to the Cyprus economy within Alpha Bank Group,” he continued.

Key Highlights

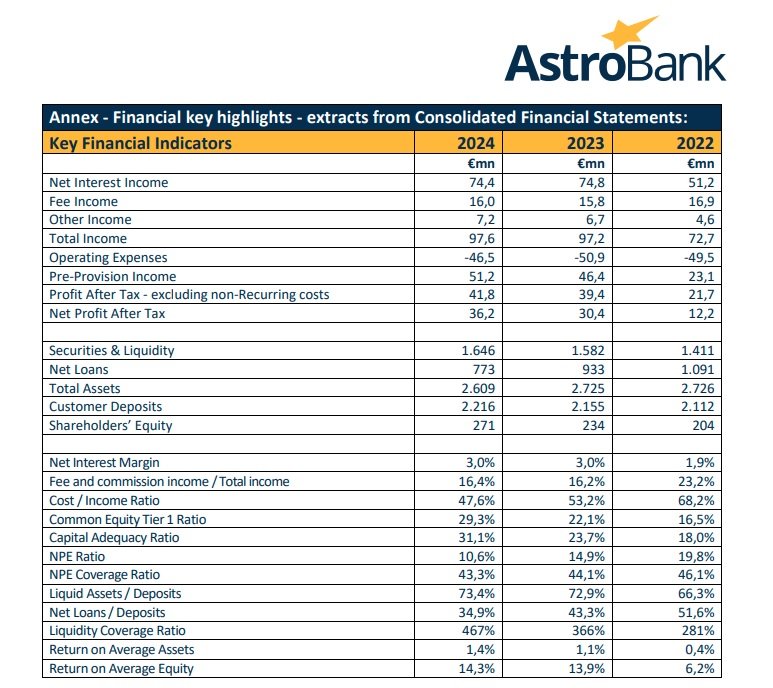

- Profit after tax before one-off costs at €41,8 million for the year 2024

- Net profit at €36,2 million compared with €30,4 million in 2023

- Significant organic capital generation; Total Capital ratio at 31,1% and 29,3% CET1 ratio

- MREL ratio at 35,8% exceeding the final binding target of 26,0%

- NPEs to loans reduced to 10,6%, from 14,9% in 2023, exclusively through organic reduction

- Cost to Income ratio reduced to 47,6% from52,3% in 2023

- Return on Equity of 14,3% in 2024 vs. 13,9% in 2023

Income Statement Analysis

AstroBank reported Profit After Tax of €36,2 million for 2024, representing a RoE of 14,3%, compared with €30,4 million and RoE of 13,9% in 2023.

The Group’s Profit After Tax before non-recurring costs [Non-recurring costs of €5,6 million represent a €3,6 million Voluntary Retirement Scheme Cost (VRS) and €2,0 million of Servicer‘s (ex-Quant) amortisation cost re-acquired back in 2022] for the year ended 31 December 2023, amounted to €41,8 million (2023: €39,4 million).

Total operating income was €97,6 million, remaining mostly stable overall compared with €97,2 million in 2023.

Net fee and commission income and other non-interest income increased to €23,3 million compared with €22,5 million in 2023.

Total expenses for 2024 were €46,5 million, down by 8,7%, compared with €50,9 million for 2023.

Personnel costs represent 57,0% of total expenses, at €26,5 million for 2024, down by 2,1% from €27,1 million in 2023. During 2024, the Group completed a voluntary redundancy scheme (VRS) through which 25 full-time employees were approved to leave at a total cost of €3,6 million (2023 VRS: 55 employees at a total cost of €7,0 million). The number of permanent staff on 31 December 2024 was 365 (2023: 392).

Other operating expenses for 2024 were €12,9 million, down by 20%, from €16,2 million in 2023. Depreciation and amortisation reached €3,2 million compared to €3,3 million in 2023, while the special levy on deposits and other contributions amounted to €3,8 million (2023: €4,3 million).

Cost to income ratio dropped to 47,6% in 2024, compared to 52,3% in 2023, driven mainly by the Management’s ongoing focus on efficiency and cost discipline as well as on some non-recurring costs incurred in the previous year.

Pre-provisions income arising mainly from core banking activities increase by 10,3% in 2024, at €51,2 million, from €46,4 million in 2023, driven mainly by lower operating expenses.

Total impairment charges for 2024 amounted to €5,8 million compared with €6,7 million in 2023. The decrease in 2024 is primarily due to lower impairment on stock of property (Real Estate Owned Assets or REOs).

Balance sheet dynamics and capital position

The Group’s total assets amounted to €2.609 million on 31 December 2024 (2023: €2.725 million). The decrease is primarily attributable to the repayment of funding from Central Banks (Targeted Longer-Term Refinancing Operations (TLTRO) ΙΙΙ).

Net loans decreased from €933 million as of 31 December 2023, to €773 million as of 31 December 2024, mainly reflecting corporate early repayments and refinancing, the overall controlled loan growth and resolutions in the non-performing portfolio. Total new lending for the period reached around €73 million.

Customer deposits amounted to €2.216 million as of 31 December 2024 and shown an increase of 2,8% compared to €2.155 million on 31 December 2023.

Underpinned by common equity of €271,4 million, the Bank's capital adequacy ratio increased to 31,1% as of 31 December 2024, from 23,7% the previous year, due to internal capital generation, through profitability and resolution of non-performing loans. Οn 31 December 2024, the Common Equity Tier 1 ratio (CET 1) stood at 29,3% compared to 22,1% on 31 December 2023.

AstroBank's liquidity remained robust throughout the year, with a liquidity coverage ratio of 467% at 31 December 2024, well above the minimum regulatory requirement (100%).

The NPE ratio dropped to 10,6% as of 31 December 2024, from 14,9% as of 31 December 2023, exclusively through organic resolutions. Provision coverage stood at 43,3% at the end of 2024 (2023: 44,1%).

Real Estate Owned Asset, direct and indirect [indirect sales represent disposal before onboarding (i.e. on foreclosure process)], disposals reached c.€40 million, of which €34,2 million, represents direct sales. Cumulative sales over the last four years reached c.€180 million.

During 2024, capital ratios were significantly strengthened by the profit of the year and the decrease in risk weighted assets (“RWAs”). On 31 December 2024, the CET 1 and Total Capital ratios stood at 29,3% and 31,1% respectively, compared with 22,1% and 23,7% at the end of 2023. The Bank’s capital ratios remain well above the minimum regulatory requirements.

As of 31 December 2024, the MREL ratio stood at 35,8%, exceeding the final binding target of 26,0% set by the regulator.

Binding agreement for the ‘‘sale of substantially the whole of the banking assets and liabilities to Alpha Bank Cyprus’’

On 27 February 2025, the Bank reached a binding agreement on the key commercial and legal terms with Alpha Services and Holdings S.A. (“Alpha Holdings”), 100% parent company of Alpha Bank S.A. for the sale of substantially the whole of the banking assets, liabilities, and transfer of personnel of the Bank to Alpha Bank Cyprus Ltd (“Alpha Bank Cyprus”) (the “Transaction”).

The completion of the Transaction is subject to finalisation of the Transaction documentation, including obtaining the necessary regulatory approvals and consents. The Transaction is expected complete within the 4th quarter of 2025. The consideration, upon completion of the Transaction, will be at no less than €205 million.

Copies of the Audited Consolidated Financial Statements for the year ended 31 December 2024 are available at the Bank’s Registered Office, located at 1 Spyrou Kyprianou Avenue, Nicosia, as well as on the Bank’s website www.astrobank.com